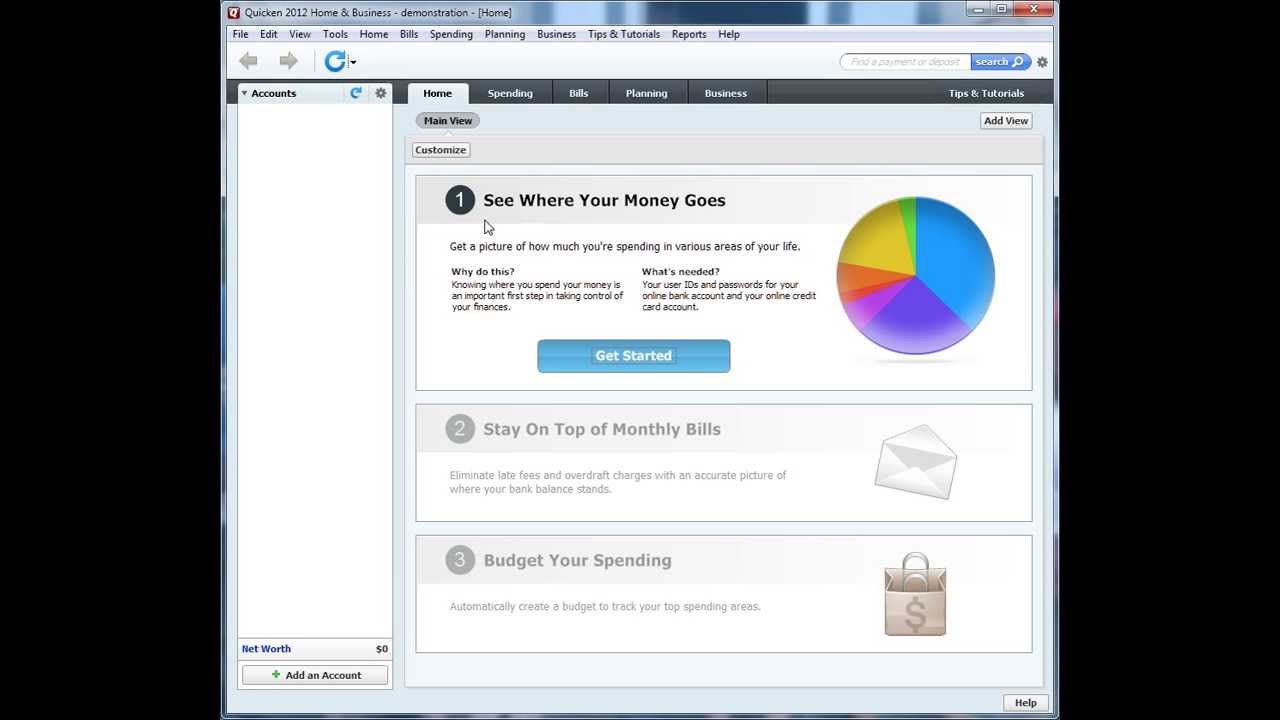

But that's an entirely different question I have no desire to ask about. It is even more frustrating that I cannot manually input my banking files into my unsupported 2017 version. If i have to categorize everything all over again I guess I will have to do that but I really do not want tot pay $99 dollars again for something I haven't even been able to use the way I need it to work. I bought it at Office Max and I would just like to use it and get my taxes done. Quicken Home and Business makes it easy to find and track business deductions - even from mixed personal.

Create your own custom reports for any tax schedule. Schedule A to E, Tax Summary, Capital Gains reports, and more. I used the product for probably 20 minutes before I uninstalled it. Additionally, note that if you are currently subscribed to Quicken Deluxe, Quicken Premier or Quicken Home & Business, by redeeming the free Quicken Starter product, you will lose some of the features that are associated with your current higher-tiered product. Spend more time on your business and less time on taxes with easy tax reports on business income, expenses, and deductions.

#Quicken home and business online activation code#

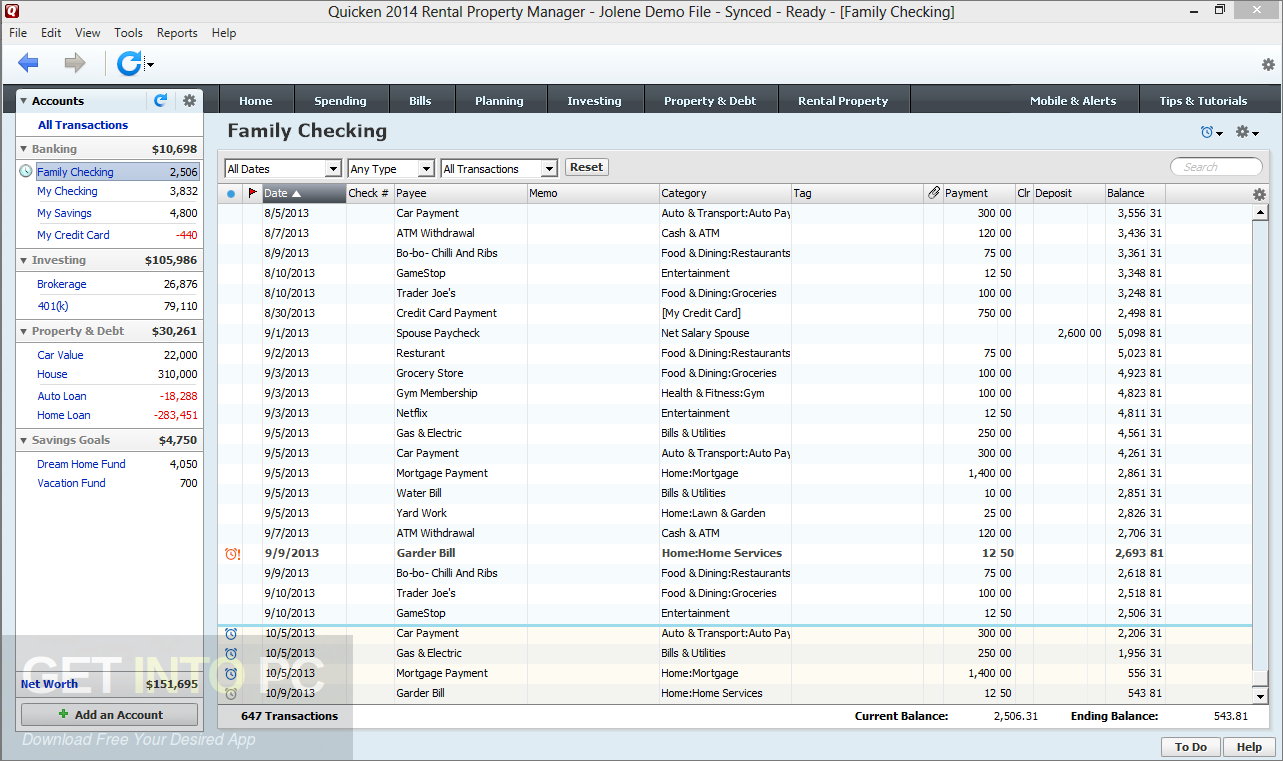

Because I had already used the activation code that came with the disc the first time I installed the program it will not let me do it again with that same code. Currently since my 2017 version expired I no longer have had access to use it like I had before and decided to reinstall my 2019 CD. Pretty much forgot all about until recently. I did not have the time to deal with this so I uninstalled 2019 and went back to my 2017 version to finish the bookkeeping I had a deadline on. After installing 2019 on my computer, updating all my files to the newer version, none of my personalized categories, payee's, etc, were transferred over from 2017 to 2019. Upgraded to 2017 and then again to 2019 last year. I've been using Quicken home and business version on CD since 2014.

0 kommentar(er)

0 kommentar(er)